In the fast-paced world of trading, position traders stand apart. While day traders chase quick profits and swing traders look for short-term momentum, position traders focus on capturing significant market moves that unfold over weeks or months. This approach requires patience, discipline, and most importantly—the ability to identify genuine market trends while filtering out market noise.

DeltaPredict's advanced scanning technology has become an essential tool for position traders looking to identify high-probability, long-term setups. By leveraging multi-timeframe analysis and proprietary algorithms, position traders can spot emerging trends early and ride them to substantial profits. Let's explore how serious position traders are using DeltaPredict to transform their trading results.

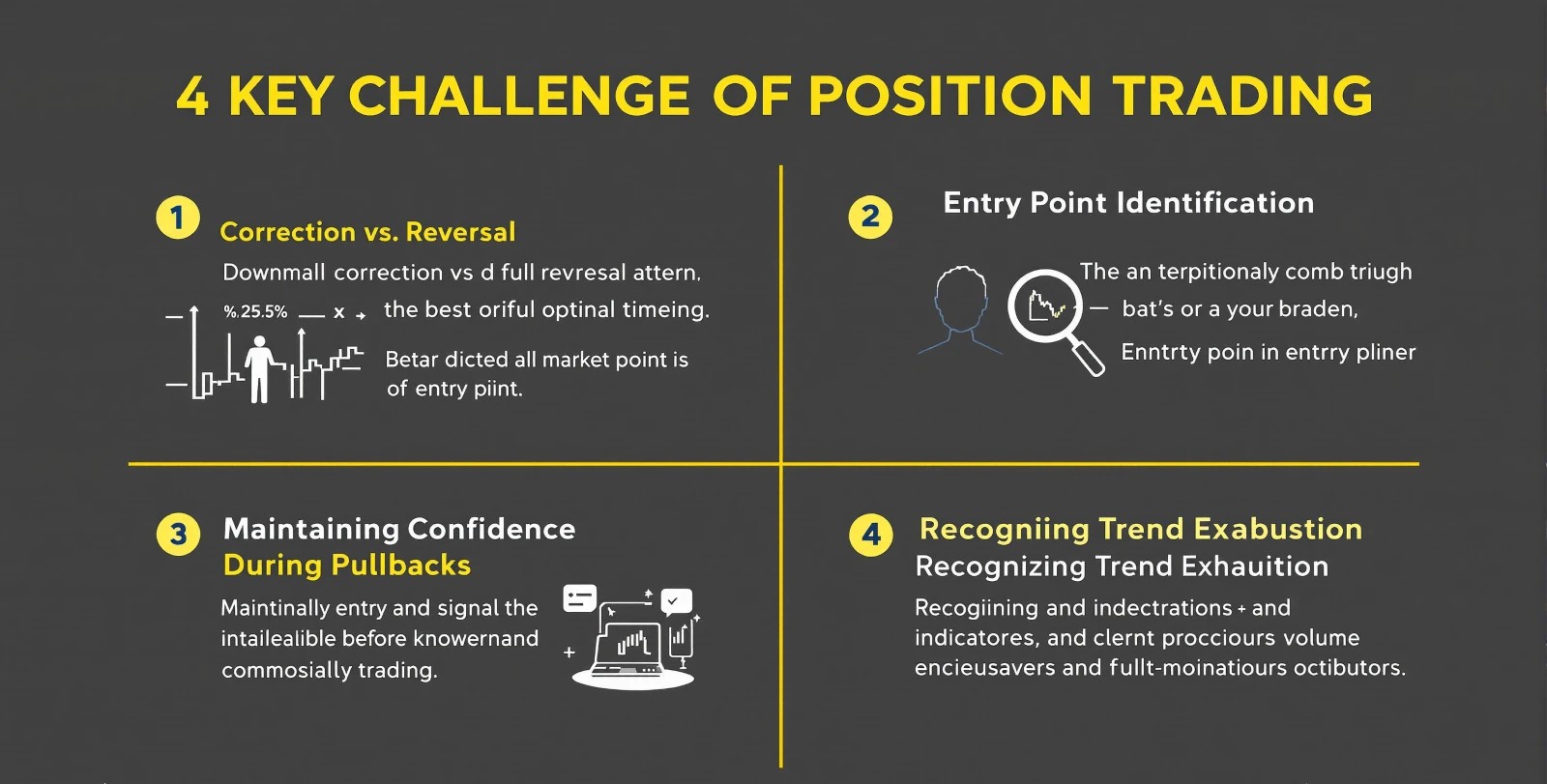

The Position Trader's Challenge

Position trading offers compelling advantages: lower stress, reduced transaction costs, and the potential for outsized returns when major trends develop. However, it comes with unique challenges:

- ✔ Distinguishing between temporary corrections and trend reversals

- ✔ Identifying optimal entry points that minimize drawdowns

- ✔ Maintaining conviction during inevitable pullbacks

- ✔ Determining when a trend has truly exhausted itself

Traditional technical analysis often falls short in addressing these challenges, leaving position traders vulnerable to premature exits or holding positions well past their prime. This is where DeltaPredict's sophisticated technology creates a significant edge.

DeltaPredict's Position Trading Framework

Successful position traders using DeltaPredict follow a systematic approach that leverages the platform's unique capabilities:

Step 1: Trend Identification Using Multi-Timeframe Confluence

Position traders begin by using DeltaPredict's Multi-Timeframe (MTF) analysis to confirm genuine trends. The platform automatically analyzes price action across daily, weekly, and monthly timeframes, identifying stocks where all three timeframes show alignment.

"The MTF confluence scanner is my first filter," explains Michael Chen, a position trader who manages a seven-figure portfolio. "When DeltaPredict shows alignment across daily, weekly, and monthly charts, I know I'm looking at a potential trend with staying power, not just market noise."

This approach dramatically reduces false signals and helps position traders focus only on setups with the highest probability of developing into sustained trends.

Step 2: Structural Analysis Using the Quantum Pattern Recognition System

Once potential trend candidates are identified, DeltaPredict's Quantum Pattern Recognition system analyzes market structure to identify optimal entry points. This proprietary algorithm identifies:

- ✔ Base formations with decreasing volatility

- ✔ Volume patterns suggesting institutional accumulation

- ✔ Price consolidation near key support levels

- ✔ Decreasing selling pressure before breakouts

The system assigns a Structural Integrity Score (SIS) to each potential setup, allowing position traders to prioritize the highest-quality opportunities.

"Before DeltaPredict, I would often enter positions too early and endure unnecessary drawdowns," says Chen. "The Structural Integrity Score helps me time my entries at points of maximum opportunity with minimal risk."

Step 3: Trend Confirmation with the Purple Rain Algorithm

DeltaPredict's Purple Rain Algorithm provides position traders with powerful trend confirmation signals. This proprietary indicator analyzes multiple data points to determine when a stock has transitioned from accumulation to markup phase—the ideal time for position traders to establish their positions.

The algorithm monitors:

- ✔ Institutional money flow

- ✔ Relative strength compared to sector and market

- ✔ Volume characteristics during price advances

- ✔ Momentum divergences and convergences

When the Purple Rain Algorithm signals a trend confirmation, position traders receive an alert with detailed analysis and suggested entry parameters.

Step 4: Position Management with Dynamic Support Levels

Perhaps the most challenging aspect of position trading is managing positions through inevitable corrections and pullbacks. DeltaPredict's Dynamic Support Level (DSL) technology addresses this challenge by continuously calculating key support levels based on:

- ✔ Volume-weighted price action

- ✔ Historical pivot points

- ✔ Institutional accumulation zones

- ✔ Moving average confluences

These dynamic support levels adjust as the trend develops, giving position traders clear guidelines for managing their risk.

"The DSL feature has transformed my ability to stay in trends," explains Rebecca Torres, who transitioned from swing trading to position trading after discovering DeltaPredict. "Before, I would often exit positions prematurely during normal pullbacks. Now, I have objective criteria for distinguishing between healthy corrections and actual trend changes."

Step 5: Trend Exhaustion Detection

Knowing when to exit a position is just as important as knowing when to enter. DeltaPredict's Attack Momentum Detection system helps position traders identify when trends are losing steam by monitoring:

- ✔ Decreasing momentum on higher timeframes

- ✔ Volume characteristics during price advances

- ✔ Bearish divergences in proprietary indicators

- ✔ Changes in institutional positioning

When multiple exhaustion signals appear, position traders receive alerts suggesting partial or complete position exits, helping them preserve profits before major reversals occur.

Case Study: Mark Johnson's NVDA Position

Mark Johnson, a position trader with 15 years of experience, credits DeltaPredict with helping him capture one of his most profitable trades ever in NVIDIA (NVDA).

"In early 2024, DeltaPredict's MTF scanner identified NVDA as having perfect alignment across daily, weekly, and monthly timeframes," Johnson explains. "The Structural Integrity Score was 92 out of 100, suggesting an extremely high-quality setup."

Johnson established his initial position when the Purple Rain Algorithm confirmed the trend at $118. Over the following months, he used DeltaPredict's Dynamic Support Levels to manage his position through several corrections.

"There were at least three significant pullbacks where I might have exited in the past," he notes. "But DeltaPredict's DSL showed that support levels were holding, and the Attack Momentum indicators weren't showing exhaustion signals."

Johnson added to his position during these pullbacks, ultimately accumulating 2,000 shares at an average price of $137. When DeltaPredict finally showed multiple exhaustion signals in late 2024, he began scaling out of his position between $123 and $149.

"The total profit was over $24,000," Johnson says. "What's most important is that DeltaPredict gave me the confidence to stay with the trend through volatile periods. Without the objective data it provided, I would have exited far too early."

The Position Trader's Edge: Fewer, Better Trades

While day traders might execute dozens of trades weekly, successful position traders using DeltaPredict often make just 6-10 trades annually. This selective approach, powered by DeltaPredict's advanced filtering capabilities, leads to several advantages:

- ✔ Reduced transaction costs and tax efficiency

- ✔ Lower stress and time commitment

- ✔ Ability to capture exponential moves in trending markets

- ✔ Improved risk-adjusted returns

"Position trading with DeltaPredict has completely transformed my relationship with the market," says Torres. "I spend less than an hour daily reviewing setups and managing positions, yet my returns have increased substantially. More importantly, I'm no longer glued to screens all day, which has improved my quality of life tremendously."

Implementing DeltaPredict in Your Position Trading Strategy

For traders interested in adopting a position trading approach with DeltaPredict, consider this implementation framework:

- ✔ Set up custom MTF scans focusing on weekly and monthly timeframe alignment

- ✔ Filter for stocks with Structural Integrity Scores above 80

- ✔ Wait for Purple Rain Algorithm confirmation before entering positions

- ✔ Use Dynamic Support Levels to determine initial stop placement

- ✔ Develop a scaling plan for both entries and exits

- ✔ Monitor Attack Momentum indicators for potential trend exhaustion

DeltaPredict offers comprehensive training on position trading strategies through its Academy, including specialized modules on trend identification, position sizing, and risk management for longer-term positions.

Conclusion: The Patient Path to Consistent Profits

In a market environment dominated by short-term thinking, position trading with DeltaPredict offers a compelling alternative. By focusing on genuine trends and using sophisticated technology to filter out market noise, position traders can achieve exceptional returns while maintaining balance in their lives.

"The most valuable aspect of DeltaPredict for position traders isn't just the technology—it's the confidence it provides," explains Chen. "When you know your decisions are backed by objective data across multiple timeframes, you can ignore the day-to-day noise and focus on the bigger picture."

For traders tired of the stress and inconsistent results of shorter-term approaches, DeltaPredict's position trading framework offers a proven path to sustainable success in the markets.

Ready to transform your trading approach? Start your free trial of DeltaPredict today and discover how our advanced technology can help you identify and capitalize on the market's most powerful trends.

About the Author

This article was written by the DeltaPredict research team, drawing on analysis of over 50,000 day trades and feedback from our community of professional traders.